Despite the pandemic’s uncertainty, last year saw nearly 30% of IT employees leaving their company for better jobs and career opportunities. If you are a student or recent college graduate with the question “I am working in a company where I signed a contract while joining. But, now I want to quit. What do I do now?”, we’ve got answers for you. Whether you received a better offer with a higher salary from another company, or you just don’t fit in your current company, this blog will help you break your employment contract with minimal damage. By the end of this read, you will have complete clarity about what exactly is a bond, why companies make you sign one, what a bond means for your career, and how you can break the bond and seize a better opportunity

By the end of this read, you will have complete clarity about

- What exactly is a bond?

- Why do companies actually make you sign a bond?

- What does a bond mean for you?

- How can you break the bond and seize a better opportunity?

Let’s get started!

What is an employment bond?

A bond is a contract between the employer and the employee.

It states that the employee will work in the company for a specific period after joining or from the moment training begins.

If the employee wishes to leave before the agreed time, he/she will have to pay the employer a certain amount, called “liquidated damages”, as compensation.

Why do companies make you sign a bond?

If you’re a fresher straight out of college, there’s a possibility you’re not fully qualified. Companies invest in training programs and courses to develop your skills. After acquiring these valuable skills, if you choose to leave the company, the company faces substantial losses in terms of money, time, and human capital. It is in such cases that a company opts for bonds. This is a common practice, even for entry-level developer roles.

Is signing a bond good?

Every individual has a different take on it. For some, it might be a good idea. While for others, it can be the worst idea to sign a bond agreement.

If your company asks you to sign a bond, be sure to consider the following:

- What are the terms and conditions?

- How long is the bond period?

- When does the bond period start and when does it end?

- What is the compensation you’ll have to pay if you breach the agreement?

- Why is there a contract in the first place?

- Who is involved in this agreement?

It definitely matters if a company is a suitable fit for you, but never let that be the sole consideration when signing a contract with them.

What will happen if I break an employment bond?

While working with a certain organization, you may actually end up stumbling upon job opportunities in some other place that is better than that of your own. The pay might be much higher than your present salary or the job location may be more suitable for you. In some circumstances, it might also mean a chance to work at your dream company.

In such a case, if you have signed a bond, you might not be able to proceed. But, there’s a way around it.

If you have signed a 2-year bond

You don’t have to wait for 2 years entirely to leave the current job.

You can always check with your employer on what your alternatives are. It could be possible that they’d be willing to help smooth the transition by you serving your notice period or you could try looking at the opportunity cost.

How to look for the opportunity cost?

Let’s assume that your current salary is 3.5 LPA.

And you have signed a bond for 2 years.

Note: Your bond begins from the day you join the organization.

In case you wish to leave before the bond period ends, you have to pay a hefty sum of 2 lakhs. (this amount is an assumption for calculation purposes)

Sounds scary, right?

Not really! Let’s look at what the opportunity cost is so that you can make a calculated decision.

Consider these 2 cases.

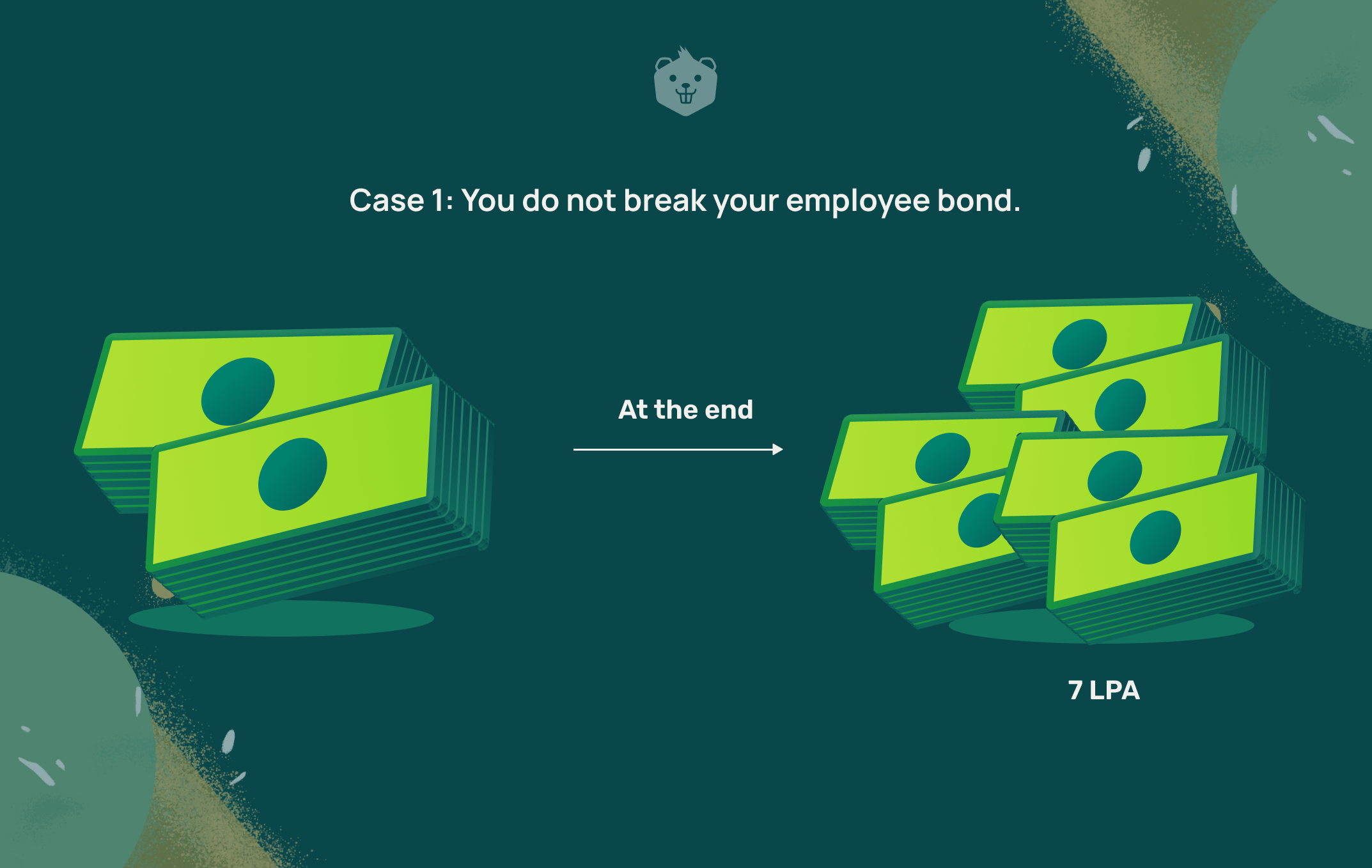

Case 1: You do not break your employee bond

If you choose to stay in the same organization till your bond period ends, your earnings at the end of 2 years would be 7 lakhs.

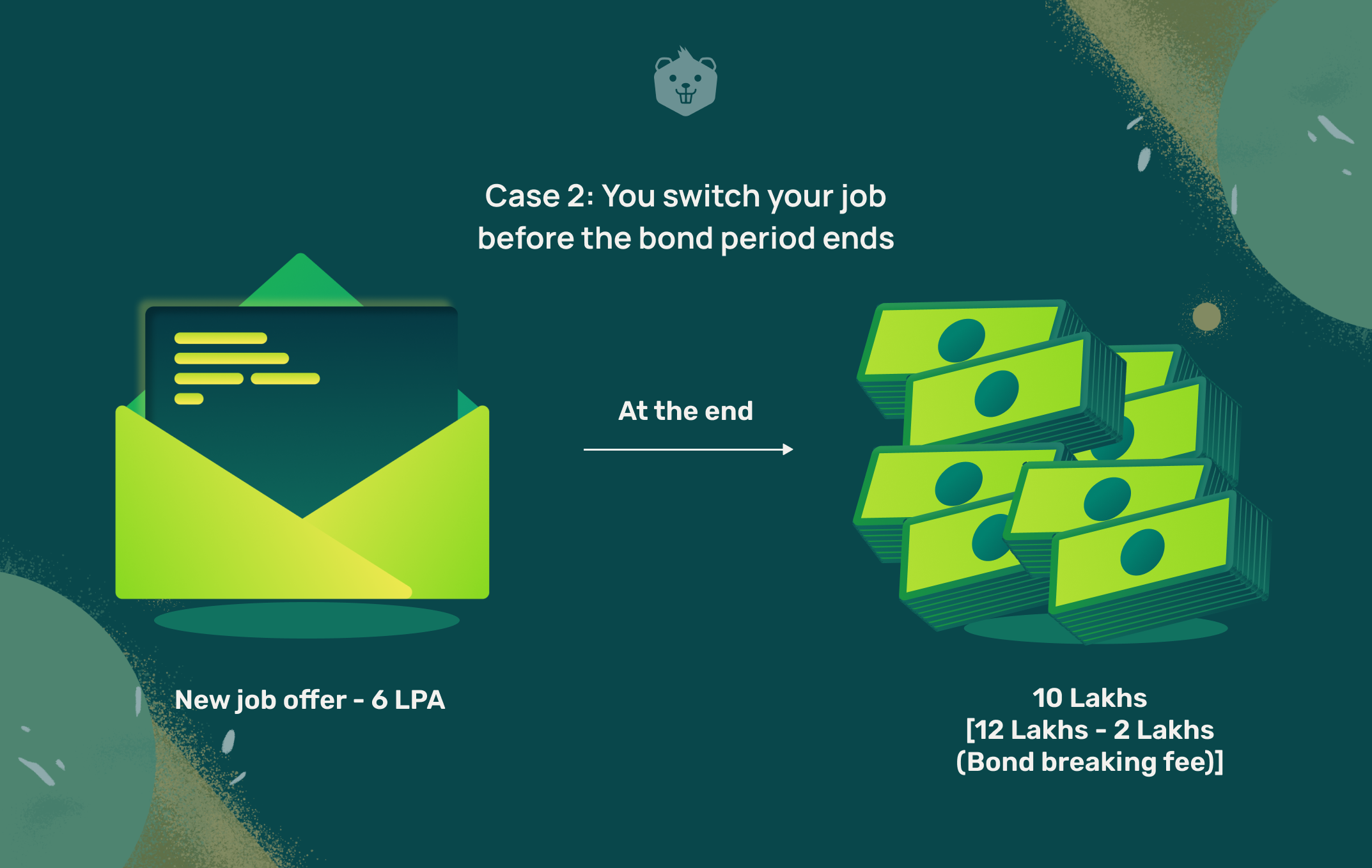

Case 2: You leave before the bond period ends

New job offer: 6 LPA

In this case, you would have 12 lakhs at the end of the same 2-year period, however because of the 2 lakhs bond breaking fee, you would be left with 10 lakhs.

Which case appeals more to you?

In case you are going with Case 2, your next thought maybe -

“How do I arrange for 2 lakhs upfront right now?”

Here’s what you can do:

- Take a personal loan showing an offer letter from the next company.

- Negotiate for a joining bonus (most companies are accommodating of this request.)

- Ask your family/friends to lend you money which you will pay back in installments.

Sounds doable, and less intimidating, right?

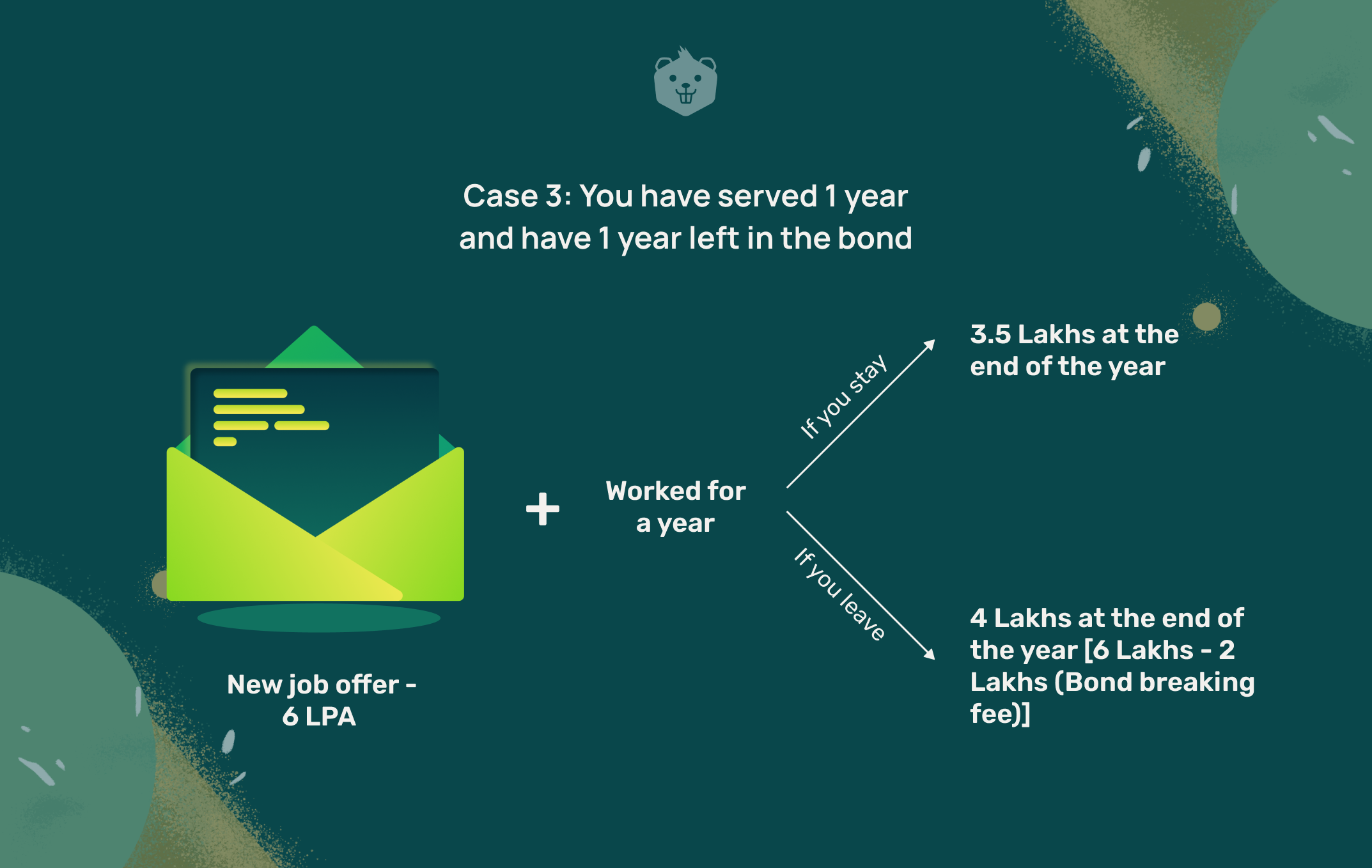

In case you are wondering, what about a Case 3 where you have already served 1 year and aren’t sure if this makes sense for you. We’ve got you covered as well.

Case 3: You have served 1 year and have 1 year left in the bond

New job offer: 6 LPA

At the end of 1 year,

If you stay, you will have 3.5 lakhs.

If you leave, you will have 4 lakhs (6 lakhs - 2 lakhs paid for breaking the bond).

Leaving is still a profitable choice as your next salary bump will be based on 6 LPA and not 4 LPA.

Final thoughts

At the end of the day, a bond-breaking fee is a company’s form of compensation for the money and time spent on you as an employee. And a bond is a legit legal tender.

Breaking a bond despite signing it for a said amount of time is still fine if done the right way.

Do these 3 things for a smooth transition to your new job.

- Evaluate the opportunity cost.

- Maintain a good relationship with the company.

- And satisfy the terms of your contract.

If you are still in 2 minds about breaking your employment bond, watch this: